- Apr 02, 2021

- Mobile App Development

- 28411

Share this post on:

The process of taking a loan is a big headache but now has been reduced to some extent. Technology has transformed various aspects of our lives and the same goes for the financial sector too. It allows the consumers to complete the entire process easily and systematically.

The loan lending mobile app development process is the easiest way that offers end-to-end solutions for getting the loan approved.

Working of a Loan Lending App

A loan lending mobile application allows the users to borrow money from banks at an interest rate set by the bank. You can compare the interest rate for different banks and check out the one that suits you and lends you money easily.

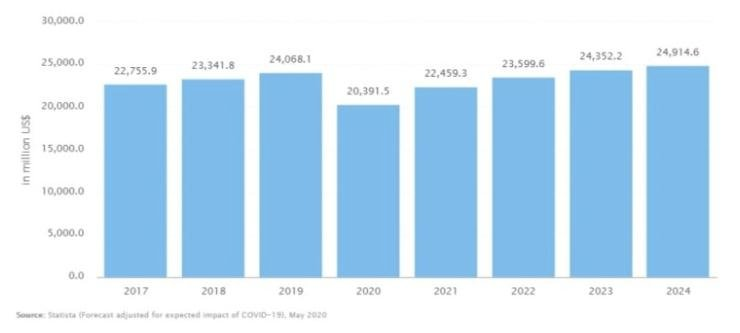

The market for the loan application is gradually watching a boom this year and as per a report from Statista the marketplace lending segment will go up to USD 20,391.5 million this year and by the end of 2024, the market size will increase to USD 24,914.

The app is another credit card that allows users to get a loan instantly. Once the user installs the apps and registers, they can fill in all their details and check whether they are eligible for the loan based on the bank details or not. You can save your time, that otherwise you would be spending in long queues in the bank and talking to the bank officials.

Numerous Money Lending Apps you can Choose From

The type of money lending app you want to develop entirely depends on the target audience. Because each person has different needs there are different types of users and loans, one can avail. Whether you are looking forward to a specific lending app or an alternative here is a list you can select and get your app developed:

1. Student Loan

In India, a student loan is taken majorly and offering them a loan lending application is one of the best choices. Students prefer taking loans for their higher studies or going Abroad. Only they need to show all their certificates and the loan is sanctioned immediately. Our loan lending app developers can preferably develop such an app for you.

2. Home Loan

Everyone prefers a house of their own. Want to assist with the home loan to the users? We offer the best solutions that help you reach a wider audience and target them with ease ensuring your app is quick and safe to use.

3. Business Loan

Whether one wants to start their business or expand their facilities, the business loan helps the owners and startups to get bigger, grow, and become stronger. Rest we would take care of how to create a loan app that fits your needs.

4. Car Loan

Give a more luxurious life to all your users with loan lending mobile apps. All you need to do is reach the perfect and cost-effective mobile app development company and get the customized app developed as per your business needs.

Benefits of a Loan Lending Mobile App

1. Quickly Approved with Instant cash Access

Loan applications are much faster than the traditional methods of going to the banks and waiting in queues. Yes, it was a tedious and time-consuming task. Once you apply for the loan with the online application, the decision of lending is made within seconds and you get a loan faster than you can ever imagine.

2. Maximum Reach

Yes, apps offer the benefits of maximum reach! Banks may not be able to reach everyone especially the rural areas. With the mobile apps you can bridge this gap between the lender and borrower while leveraging the benefits even they are at a far distance from one another.

3. No Paperwork Involved

There is no hustle of keeping the documents safe. As all the documents are submitted online the user only needs to upload the scanned documents making it easy for both the lender and the borrower to give/take loans.

4. App is safe and secure

When it comes to money, security is a major concern, and it’s understandable. With the mobile loan application, you get assured that they are 100% safe and trustworthy. There isn't any risk associated with losing money, and also it safeguards all your personal information and passcodes.

It uses the most advanced encryption technologies to ensure your financial and personal information is secure.

5. Saves Time and Effort

Did you ever imagine getting a loan approved with a single tap? Yes, whether you are traveling, or out somewhere you can instantly apply for the loan with a tap. Moreover, for any queries in between, you get 24/7 access to the services.

Also, the eligibility, approval, and all other documentation process are much faster for the money lending applications that ultimately saves your time and effort.

Why Invest in a Loan Lending Mobile Application?

As the demand for loan lending applications has exponentially increased within years, it is one of the most crucial decisions to invest in a loan lending application.

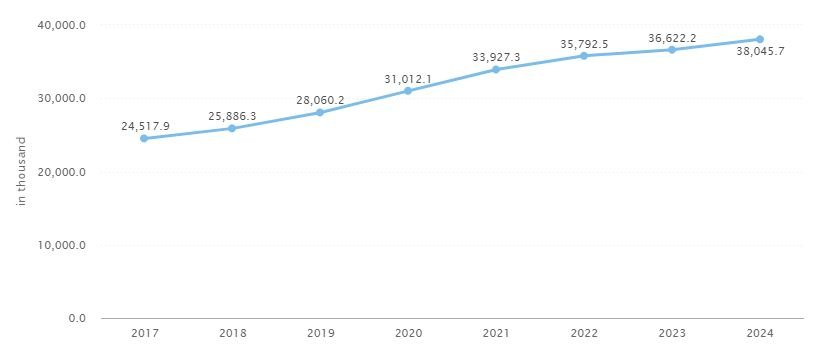

Stats for Number of Loans from 2017 to 2024

But one has to offer the latest and advanced features that help you stand out from the crowd. As per research in the US, 31% of the people responded that there should be an easy and quick option that helps to make the process of borrowing much simpler.

These are also becoming more popular as they offer end-to-end solutions to all the queries and provide solutions whether it is regarding the loan, interest rate, credibility, approval, and much more.

What are the Key Features of Money Lending Mobile App?

Key features of User panel

1. Registration/Login

Users should be easily able to register themselves via social media or e-mail credentials and fill out all the details asked on the registration page.

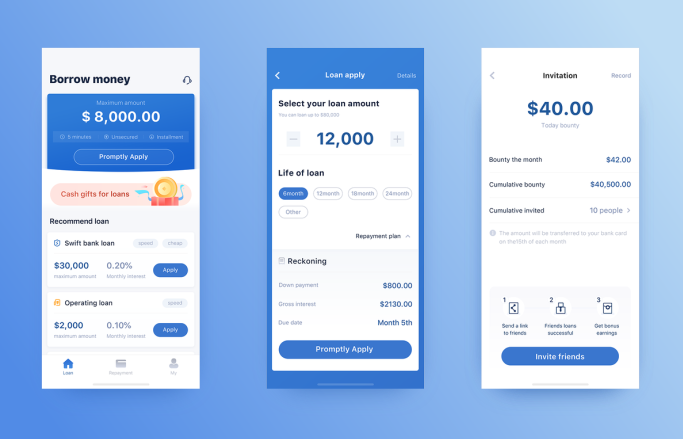

2. Quickly Apply for Loan

Users should be able to apply for the loan instantly with a single tap while selecting the options such as the amount of money, EMI they are lending and what needs to be paid, GST to be paid, and another processing fee.

3. Set Payback Period

Users should be given the time to choose when to payback looking at the payback period and the EMI being levied. The amount of interest depends on the period you would be paying back the amount.

4. Transactions

The transaction shows the entire summary of the amount borrowed, amount withdrew the available limit, and all other details. You can select whether the amount is paid via a credit card, debit card, or any other digital payment method.

5. 24/7 Online support

If the user faces any query, they can contact the support team via the application support.

Key features of Admin Dashboard

1. Login

The admin should be able to login into the dashboard via the login credentials.

2. Approval of profile

The admin would verify the user-profile and approve it if the information provided is valid. All the other information such as PAN, documents, credit/debit card details need to be verified.

3. Manage users

If there are any issues or the admin finds out that the user is violating the terms and conditions of the application, the admin should have an access to block the user.

4. Manage Dashboard/Earnings

Admin here manages the earning of a user, and they can view the entire month, week, or daily earning and if there is any pending income too.

5. Loan Management

The entire loan is managed by the admin. The rate of interest may vary for all the different types.

Some of the Advanced Features of Loan Lending Application

- Push Notifications: To check out the latest activities, features, and any other discounts offered, this feature works the best way. Without opening the app, again and again, the user is updated with all the information of the loan lending application.

- Bank Partner Management: With this feature, the app can function along with the other collaborated banks.

- Multiple Language Support: If one wants to apply for a loan in some other country, they can opt for this option so that can choose the currency from the options available.

- CMS Integration: With the integration of this feature, the owner of the app can manage content on digital money lending applications.

How much does it cost to develop a Loan Lending Mobile App?

Numerous factors determine and affect the pricing of the loan lending application. The mobile app development of such kinds of applications can be customized, and therefore plays a significant role in deciding the cost. A few of the factors involved are:

- The number of custom features integrated into the app

- The design of the application

- Time is taken for the app development

- App Platforms preferred

- The complexity of the app

Winding-up

As already discussed the popularity of the loan lending mobile applications, if you are a startup you must invest your money into it. Hope the above guide has offered ample knowledge to build a top-notch money lending application for your business.

If you are looking for someone and needs assistance with transforming your dream app into a reality, we are up for help!

OZVID is an award-winning organization with the longstanding experience to handle all your project complexities.

Drop us a line and know about our app development services!