- Aug 28, 2025

Share this post on:

The financial industry has undergone a massive transformation over the past decade, shifting from traditional banking to digital-first experiences. With the rise of online banking apps and mobile banking, customers now expect seamless, secure, and instant access to their finances anytime and anywhere. This rapid change has created a booming demand for advanced banking app development that combines innovation, security, and user-centric features.

As a leading mobile banking app development company, OZVID Technologies has been at the forefront of building scalable and feature-rich banking applications that help banks, fintech startups, and financial institutions embrace the digital era. The next phase of growth is driven by AI in banking, custom business models, and the increasing need for personalization in financial services.

In this blog, we will provide a complete guide to the future of banking app development, covering the different types of banking apps, the importance of AI, development steps, costs, features, and the latest industry trends. We will also explain why choosing OZVID Technologies as your trusted banking app development company can accelerate your digital journey.

Key Takeaways

- AI and ML are reshaping mobile banking with personalization and fraud prevention.

- Biometric authentication ensures higher security and customer trust.

- Blockchain enables transparent transactions and digital currency adoption.

- Voice-enabled and contactless banking enhance speed and convenience.

- Big data drives hyper-personalized financial services for users.

Types of Banking Apps

The digital banking ecosystem has diversified over the years, giving rise to multiple types of banking apps that cater to different customer segments and business requirements. Each type of bank application is designed to solve specific problems and provide unique functionalities to users. Understanding these types is crucial for banks, fintech companies, and financial institutions looking to invest in mobile banking app development.

Here are the major categories of online banking apps and their significance in the evolving financial industry:

1. Retail Mobile Banking Apps

Retail banking apps are the most widely used mobile banking applications designed for individual customers. These apps act as digital extensions of physical bank branches, allowing users to access their financial accounts anytime, anywhere.

Key Features of Retail Banking Apps:

- Checking account balances in real time.

- Viewing transaction history and monthly statements.

- Transferring money to friends, family, or other bank accounts.

- Paying utility bills such as electricity, water, gas, and internet.

- Setting up recurring payments and managing standing instructions.

Importance:

Retail apps are at the core of customer satisfaction in modern banking. They reduce the dependency on physical branches, provide instant services, and allow banks to reach millions of users directly through smartphones. These apps also act as a foundation for building customer loyalty by offering a smooth and secure user experience.

2. Corporate Banking Apps

While retail apps cater to individual users, corporate banking apps are designed for businesses and enterprises that handle large-scale financial transactions. They provide advanced features tailored to the complex needs of corporations.

Key Features of Corporate Banking Apps:

- Bulk payment processing for vendors and employees.

- Payroll management with automated salary transfers.

- International remittances and foreign exchange services.

- Real-time dashboards showing account balances across multiple branches.

- Risk management and compliance tools integrated into the platform.

Importance:

For businesses, managing finances efficiently is a critical priority. Corporate banking apps allow enterprises to automate their financial operations, reduce manual errors, and save valuable time. These apps also strengthen relationships between banks and corporate clients, as they provide an added layer of convenience and security in financial management.

3. Wealth Management and Investment Banking Apps

Wealth management apps go beyond traditional banking functions and help customers grow their money through investments, trading, and portfolio management. These apps are primarily used by investors, high-net-worth individuals, and customers who want financial planning tools at their fingertips.

Key Features of Wealth Management Apps:

- Portfolio tracking and performance analysis.

- Stock market and mutual fund investment options.

- AI-driven investment suggestions and risk profiling.

- Real-time financial news and analytics.

- Integration with tax and retirement planning tools.

Importance:

With the growing trend of digital investments, wealth management apps offer a modern way to manage and expand financial assets. By integrating AI in banking applications, these apps also provide personalized investment advice, making them invaluable for customers looking to build long-term wealth.

4. Neo Banking Apps

Neo banks are completely digital banks that operate without physical branches. A mobile banking app development company builds these apps to provide all banking services through smartphones. Neo banks often collaborate with licensed traditional banks but rely heavily on technology for customer acquisition and service delivery.

Key Features of Neo Banking Apps:

- Instant account opening without visiting a branch.

- Zero paperwork for most banking services.

- Mobile-first features like QR-based payments and digital wallets.

- Expense categorization and savings goals for customers.

- Integration with financial management tools and APIs.

Importance:

Neo banking apps represent the future of digital transformation in banking applications. They are cost-effective for banks since they eliminate the need for physical infrastructure. For users, they offer unmatched convenience and accessibility, making banking faster, smarter, and more transparent.

5. Lending and Loan Apps

Lending has always been a key service in banking, and with digital transformation, the process has become faster and more efficient through dedicated loan apps. These apps are either developed by banks or by fintech startups specializing in credit services.

Key Features of Lending Apps:

- Instant loan applications and digital verification.

- AI-driven credit scoring and risk analysis.

- EMI calculators and repayment schedules.

- Loan disbursement tracking.

- In-app reminders for repayment deadlines.

Importance:

The use of AI in banking applications has significantly transformed lending apps. With automation, loan approvals that previously took weeks can now be completed within minutes. These apps also enable banks to expand their reach by offering microloans, student loans, and personal loans to a wider audience.

6. Payment and Wallet Apps

While not strictly limited to traditional banks, payment and wallet apps are an integral part of the modern financial ecosystem. A finance app development company often creates these apps to facilitate digital payments and integrate them with existing bank applications.

Key Features of Payment Apps:

- Peer-to-peer money transfers.

- Integration with debit/credit cards and bank accounts.

- QR code-based transactions for retail purchases.

- Online shopping payments and subscription management.

- Loyalty programs, cashback offers, and rewards.

Importance:

Payment apps play a vital role in promoting cashless economies. By integrating with traditional mobile banking apps, they provide a seamless experience for users who want to make quick payments, shop online, or send money to friends and family instantly.

7. Specialized Niche Banking Apps

Apart from mainstream categories, there are niche bank applications developed for specific purposes:

- Insurance Banking Apps: Help customers pay premiums, track policies, and make claims.

- Student Banking Apps: Offer low-balance accounts, student loans, and financial education tools.

- Agricultural Banking Apps: Assist farmers with loans, subsidies, and financial literacy.

Importance:

These apps are crucial in driving financial inclusion and serving underbanked or specialized groups. A mobile banking app development company focusing on niche markets can help financial institutions expand their services to new customer bases.

Importance of AI in Banking Apps

Artificial Intelligence is no longer just a trend; it has become the backbone of modern mobile banking app development. By integrating AI, banks and financial institutions can deliver smarter, faster, and safer services. Here’s how AI in banking applications is driving transformation:

1. Fraud Detection & Risk Management

One of the most critical uses of AI in banking is real-time fraud detection. AI algorithms continuously analyze millions of transactions to identify unusual patterns and suspicious activities. Unlike manual monitoring, AI systems detect risks instantly and notify both banks and customers. This significantly reduces financial crimes, secures online banking apps, and builds trust among users.

2. Personalized Financial Services

AI allows mobile banking apps to offer highly personalized financial advice and recommendations. By analyzing user behavior, spending habits, and transaction history, AI engines provide customized insights on saving plans, investments, and credit options. This personalized experience helps customers feel more valued and improves engagement, making the banking app a trusted financial companion rather than just a service provider.

3. Chatbots & Virtual Assistants

AI chatbots and virtual assistants have become a core feature of bank applications. They provide instant responses to queries, assist with transactions, and guide users through various services without human intervention. Available 24/7, these AI assistants improve customer service, reduce call center costs, and enhance the user experience by making online bank applications more interactive and user-friendly.

4. Credit Scoring & Loan Processing

Traditional loan approvals often take weeks due to manual checks, paperwork, and verifications. With AI in banking applications, loan processing becomes much faster and more accurate. AI models analyze credit scores, repayment histories, and even behavioral data to assess risks. This ensures that decisions are fair, transparent, and speedy, making lending apps more efficient and customer-friendly.

5. Predictive Analytics & Insights

AI enhances mobile banking app development by enabling predictive analytics. By studying spending habits and transaction histories, AI systems forecast future financial needs and risks. For example, it can alert a customer about possible overdrafts, recommend savings opportunities, or suggest investment strategies. These predictive insights help banks create more meaningful interactions and empower customers to make informed financial decisions.

Benefits of Developing Banking Apps for Businesses

Investing in mobile banking app development is not just a technological move, it is a strategic business decision. Banks, financial institutions, and even fintech startups can reap immense benefits by offering user-friendly and secure bank applications. Here are the key benefits businesses enjoy by adopting modern online banking apps:

1. Enhanced Customer Experience

A mobile banking app provides customers with instant access to their accounts, services, and transactions without the need to visit a branch. This saves valuable time and eliminates long queues, offering convenience at every step. Businesses that prioritize customer experience through digital platforms build stronger relationships, increase satisfaction levels, and boost customer loyalty, essential factors for long-term success in today’s competitive financial market.

2. Increased Operational Efficiency

Through custom banking software development, businesses can automate routine processes such as account updates, bill payments, fund transfers, and loan applications. Automation reduces human errors, cuts down paperwork, and accelerates overall operations. This efficiency allows financial institutions to redirect staff and resources to more strategic areas, leading to higher productivity while maintaining accuracy in day-to-day banking operations.

3. Revenue Growth and New Opportunities

A well-designed banking app opens up fresh revenue streams for businesses. Features like digital wallets, micro-investments, premium subscription plans, and personalized financial services generate additional income. Banks and fintechs can also cross-sell products like insurance, credit cards, and loans within the mobile banking app, thereby increasing profitability. Digital platforms not only retain existing customers but also attract younger, tech-savvy audiences who prefer online banking apps.

4. Global Reach and Financial Inclusion

With mobile banking apps, geographical barriers no longer limit financial institutions. A bank can expand its services globally, reaching users across countries without setting up physical branches. This also promotes financial inclusion, as even remote or underserved populations can access banking through smartphones. Such reach helps businesses grow their customer base exponentially, contributing to both profitability and social impact.

5. Improved Security and Fraud Protection

Security is one of the top priorities in the financial industry. By investing in mobile banking app development, businesses can integrate multi-factor authentication, biometric logins, data encryption, and AI-based fraud detection. These advanced measures protect customer data and transactions while enhancing user confidence. A secure bank application not only reduces fraud risks but also strengthens the brand’s reputation as a trusted financial partner.

6. Stronger Customer Engagement and Retention

Online bank applications can include personalized notifications, offers, and AI-driven financial advice that keep users engaged. Features like transaction alerts, investment tips, and reminders for bill payments improve communication between banks and customers. Engaged users are more likely to remain loyal, purchase additional services, and recommend the app to others, helping financial institutions retain clients and grow their customer base organically.

7. Competitive Advantage in the Digital Era

The banking sector is evolving rapidly, and digital-first businesses have a significant edge. By offering a robust mobile banking app, institutions differentiate themselves from competitors still relying on traditional systems. Customers perceive such businesses as modern, tech-savvy, and customer-focused. This competitive advantage not only strengthens brand positioning but also ensures the company stays relevant in the era of digital transformation in banking applications.

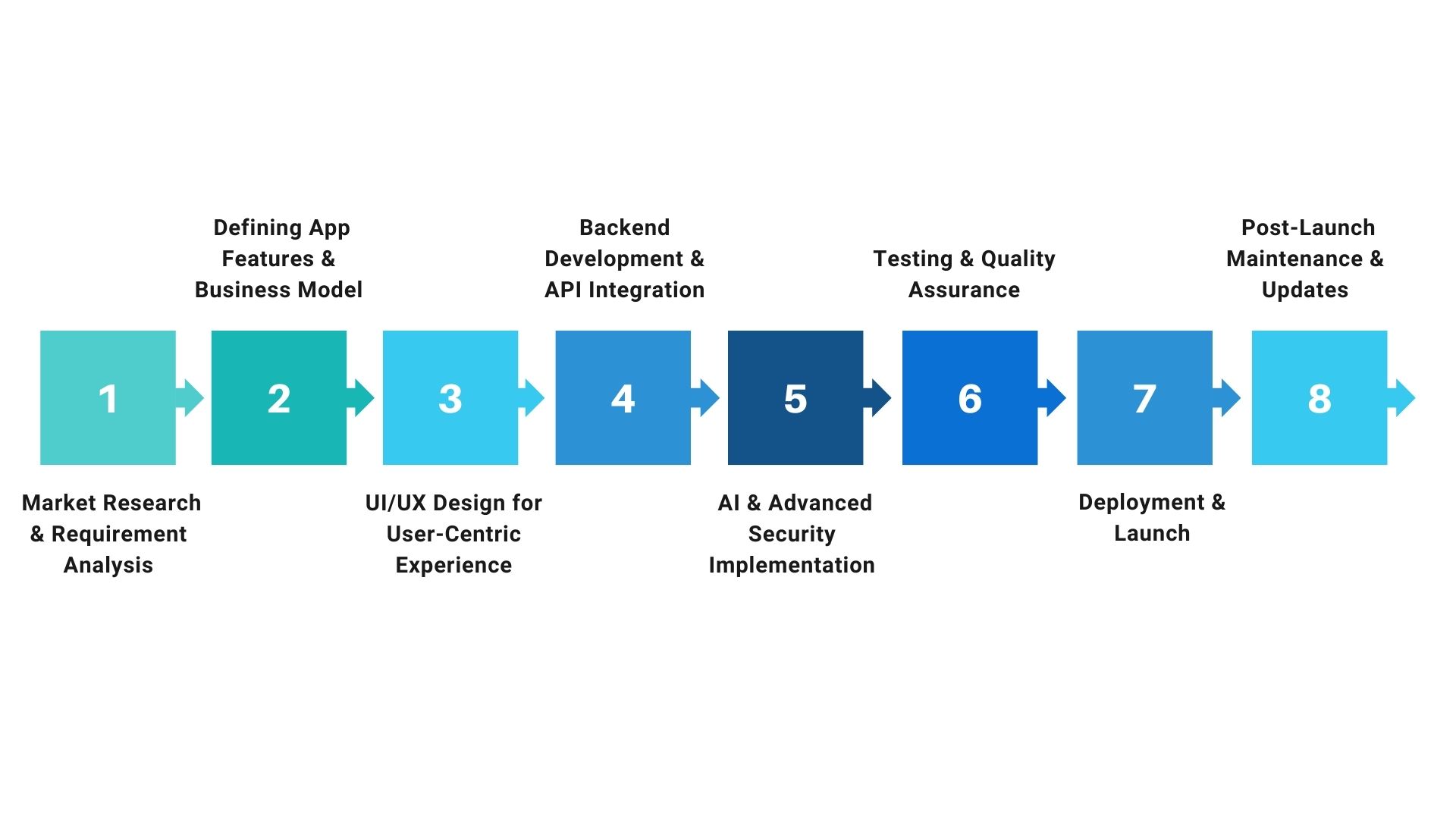

Step by Step Mobile Banking App Development Process

Developing a mobile banking app requires careful planning, cutting-edge technology, and strict security measures. At OZVID Technologies, we follow a step-by-step approach to ensure our solutions meet client needs while exceeding customer expectations. Here’s how we build powerful banking applications:

Step 1: Market Research & Requirement Analysis

The journey begins with a deep dive into the market landscape. This stage focuses on identifying customer preferences, studying competitors, and ensuring compliance with banking regulations. By aligning business goals with user expectations, we create a clear roadmap for the banking app development project.

Key highlights:

- Conduct detailed competitor analysis to identify gaps and opportunities.

- Gather user insights to define app objectives and must-have features.

Step 2: Defining App Features & Business Model

Once requirements are clear, we define the core features and the business model. Features like account management, fund transfers, biometric login, and AI chatbots are carefully planned. Meanwhile, the business model outlines how the mobile banking app generates revenue, whether through subscriptions, transaction fees, or premium services.

Key highlights:

- Select features based on customer demand and business strategy.

- Align the app’s monetization model with long-term growth goals.

Step 3: UI/UX Design for User-Centric Experience

Design plays a vital role in the adoption of a banking app. At OZVID Technologies, we emphasize creating user-friendly interfaces with smooth navigation, simple layouts, and attractive visuals. A strong design ensures customers can easily access services while enjoying a modern and engaging experience.

Key highlights:

- Focus on simplicity, accessibility, and brand identity.

- Use intuitive navigation to ensure higher adoption rates.

Step 4: Backend Development & API Integration

The backend forms the backbone of the mobile banking app. It handles all data processing, transactions, and communication with external systems. Secure APIs are integrated to enable payment processing, third-party services, and financial analytics. Our custom banking software development approach ensures apps are scalable, reliable, and secure.

- Key highlights:

- Build a strong backend architecture with security and scalability.

- Integrate APIs for payments, fraud detection, and financial services.

Step 5: AI & Advanced Security Implementation

AI has become a necessity in digital transformation in banking applications. We integrate AI-powered chatbots, fraud detection systems, and predictive analytics to enhance app intelligence. At the same time, we deploy multi-layered security such as biometric authentication, data encryption, and multi-factor verification to protect customer data.

Key highlights:

- Implement AI to personalize customer experiences and detect fraud.

- Secure the app with encryption, biometrics, and compliance measures.

Step 6: Testing & Quality Assurance

Before launch, the app undergoes rigorous testing to ensure stability and performance. Our QA process includes functionality testing, security testing, and user acceptance testing. This ensures the online bank application works flawlessly under high transaction loads and offers smooth usability to customers.

Key highlights:

- Test for performance, security, and error-free functionality.

- Conduct user acceptance tests to ensure real-world reliability.

Step 7: Deployment & Launch

After testing, the app is deployed across chosen platforms, Android, iOS, or hybrid. This step also includes compliance checks with app stores and banking regulations. OZVID Technologies ensures the bank application integrates seamlessly with existing systems and is available for customer use without technical barriers.

Key highlights:

- Ensure compliance with app store guidelines and banking laws.

- Launch on multiple platforms for maximum reach.

Step 8: Post-Launch Maintenance & Updates

Deployment is just the beginning. Continuous monitoring and regular updates keep the mobile banking app secure, competitive, and user-friendly. Our team provides long-term maintenance, introduces new features, and ensures the app stays in sync with market trends and evolving regulations.

Key highlights:

- Deliver timely updates to improve features and security.

- Monitor app performance and address customer feedback.

Must-Have Features of a Mobile Banking App

Developing a mobile banking app requires integrating features that not only deliver convenience but also ensure security, scalability, and long-term user engagement. Below are the essential features that every mobile banking app must include:

1. User-Friendly Onboarding

An easy and intuitive onboarding process is crucial for customer satisfaction. Complicated registration or lengthy verification often leads to app abandonment. A mobile banking app should offer smooth sign-up options through email, phone numbers, or social logins, followed by secure verification. Guiding users step by step ensures they can quickly access the app’s services.

- Simple sign-up with minimal steps.

- Biometric authentication for faster logins.

2. Advanced Security Protocols

Security is the backbone of banking app development. Users must feel confident that their financial data and transactions are safeguarded. Strong encryption, multi-factor authentication, and fraud detection powered by AI are mandatory. Regular security updates also prevent cyber threats from compromising sensitive banking information.

- Multi-factor authentication (MFA).

- End-to-end data encryption.

3. Account Management

Users expect seamless account access at their fingertips. A banking app should provide complete visibility into account balances, transaction history, statements, and profile details. This feature saves time, eliminates the need to visit a branch, and gives users greater financial control.

- Instant access to balance and statements.

- Transaction categorization for better insights.

4. Fund Transfers and Payments

The primary purpose of a banking app is to make fund transfers and payments hassle-free. Whether sending money to family or paying utility bills, users demand multiple transfer options, real-time updates, and minimal processing delays. Integration with popular wallets or UPI further enhances usability.

- Real-time domestic and international transfers.

- Bill payments and mobile recharges.

5. AI-Powered Chatbots

AI in banking applications is revolutionizing customer service. An AI chatbot within the app can handle FAQs, guide users through transactions, and provide 24/7 assistance. This reduces dependency on physical customer support teams while ensuring instant help whenever users need it.

- Round-the-clock automated support.

- Personalized responses based on user behavior.

6. Personalized Notifications

Timely updates improve customer engagement and prevent users from missing important information. Mobile banking apps should push personalized alerts for payments, suspicious activity, new offers, and account balance updates. AI-driven notifications enhance user experience by providing data tailored to their needs.

- Customizable notification preferences.

- Alerts for low balance or unusual activity.

7. Seamless Integration with Digital Wallets

The best online banking app provides flexibility by integrating digital wallets like Apple Pay, Google Pay, or PayPal. This gives users more options for completing transactions and enhances convenience, especially for e-commerce or contactless payments.

- Compatibility with multiple wallets.

- Faster checkout during online shopping.

8. Investment and Financial Management Tools

A modern banking app goes beyond transactions, it helps customers grow their wealth. Integrating investment options, savings calculators, and budget tracking gives users financial empowerment. This feature improves customer loyalty and positions the app as a comprehensive finance solution.

- Portfolio management with real-time updates.

- AI-powered spending analysis.

9. Customer Support Access

Even with AI chatbots, access to human customer support is still essential. A banking app must include multiple support channels like live chat, phone, and email for critical queries. Having a dedicated help section builds trust and reliability among users.

- In-app live chat with support staff.

- FAQ and knowledge base integration.

10. Card Management

Mobile banking app users expect full control over their debit or credit cards. Features like blocking/unblocking cards, setting transaction limits, or requesting new cards make card management more convenient. This reduces dependency on physical bank visits.

- Instant card blocking in case of fraud.

- Virtual card access for online shopping.

11. ATM and Branch Locator

Many users still need physical branch or ATM services. An in-app locator using GPS helps them easily find nearby facilities, saving time and enhancing convenience.

- GPS-based ATM and branch locator.

- Filters for services like cash deposit or foreign exchange.

12. Multi-Currency and Cross-Border Transactions

With globalization, customers demand apps that support multiple currencies. This feature is essential for businesses, freelancers, and international travelers who need cross-border payments without delays.

- Real-time currency conversion.

- Support for international wire transfers.

Cost to Develop a Banking App

When businesses consider investing in a banking app, one of the most crucial aspects to evaluate is the overall development cost. Building a mobile banking app involves multiple factors such as app complexity, integrations, features, platforms, design quality, and ongoing maintenance. Unlike a simple consumer-facing app, banking apps must adhere to strict security standards, compliance regulations, and advanced technology requirements, which directly affect the budget. Let’s break down the major cost-driving factors in detail:

1. App Complexity and Feature Set

The cost of banking app development largely depends on how complex the app is. A basic app with essential features like balance checks, fund transfers, and transaction history will cost much less compared to a feature-rich app with AI-driven chatbots, biometric authentication, investment tracking, and real-time analytics.

- Basic apps: $40,000 – $60,000

- Mid-level apps: $70,000 – $120,000

- Advanced apps: $150,000+

Key points:

- More features = higher cost due to added development hours.

- Advanced functionalities like AI in banking applications and custom banking software development require additional expertise and testing.

2. Platform Choice: iOS, Android, or Both

The cost will also depend on whether you want the banking app on a single platform (iOS or Android) or cross-platform. Developing for both platforms increases cost but ensures a larger audience reach.

- Single platform (iOS or Android): 25–30% lower cost than dual development.

- Cross-platform/hybrid apps: More cost-effective but may require additional optimization for banking-grade performance.

Key points:

- Target audience preferences decide whether to choose iOS or Android first.

- A mobile banking app development company may recommend cross-platform frameworks like Flutter or React Native for cost savings.

3. Security and Compliance Requirements

Banking apps cannot compromise on security. Features like end-to-end encryption, biometric authentication, and fraud detection systems require specialized expertise and increase overall cost. Moreover, apps must comply with financial regulations such as PCI DSS, GDPR, or region-specific banking laws.

- Security implementation can add 15–20% to the development budget.

- Regular compliance audits and certifications increase recurring costs.

Key points:

- Stronger security = higher cost but better customer trust.

- Compliance-related expenses are unavoidable in online banking apps.

4. User Interface & User Experience (UI/UX) Design

A banking app’s success depends heavily on its design. Customers expect a seamless, intuitive, and professional interface. Investing in UI/UX design ensures easy navigation, reduces drop-offs, and improves adoption rates.

- Basic UI/UX: $5,000 – $10,000

- Advanced, custom design: $15,000 – $30,000

Key points:

- Best online banking app requires a user-friendly design with minimal friction.

- A well-designed bank application saves customer support costs by simplifying usage.

5. Integration with Third-Party Services

Banking apps need integration with payment gateways, KYC verification, financial APIs, AI-based fraud detection systems, and analytics tools. These third-party integrations often come with additional licensing fees.

- Payment gateway integrations: $5,000 – $15,000

- AI tools & fraud detection systems: $10,000 – $25,000

Key points:

- More integrations = higher overall budget.

- Digital transformation in banking applications requires modern, scalable APIs.

6. Development Team Location & Expertise

Where you hire your development team from significantly impacts the cost. For example:

- US/UK developers: $100 – $200 per hour

- Eastern Europe: $50 – $100 per hour

- Asia (India, Philippines): $25 – $50 per hour

Choosing a finance app development company with proven expertise ensures quality but may come at a higher price.

Key points:

- Location affects cost but experience matters more.

- Offshore outsourcing can balance budget and quality.

7. Ongoing Maintenance & Updates

A banking app isn’t a one-time investment. Continuous updates, bug fixing, security patches, and new feature additions are required

- Annual maintenance cost: 15–20% of the initial development cost.

- Adding AI-driven updates or digital wallets may require new investments.

Key points:

- Mobile banking app development is an ongoing process, not a one-time project.

- Regular maintenance ensures the app remains secure and up-to-date.

8. Marketing & Deployment Costs

Beyond development, banks and financial institutions must invest in marketing, app store optimization (ASO), and customer onboarding campaigns. Deployment to the App Store and Google Play also involves compliance checks and listing fees.

Key points:

- Marketing can account for 10–20% of the overall budget.

- Visibility and adoption are as important as development.

App Type | Features Included | Estimated Development Cost | Development Timeframe |

|---|---|---|---|

Basic Banking App | Login, balance check, fund transfer, bill payments | $30,000 – $50,000 | 3 – 6 months |

Mid-Level Banking App | Advanced UI/UX, card management, transaction history, push notifications, biometric login | $50,000 – $120,000 | 6 – 9 months |

Advanced Banking App | AI-powered chatbot, fraud detection, investment tracking, personal finance management, voice banking | $120,000 – $250,000+ | 9 – 15 months |

Enterprise-Level Online Bank Application | Complete digital transformation in banking applications, blockchain integration, multi-currency support, wealth management tools | $250,000 – $500,000+ | 12 – 18 months |

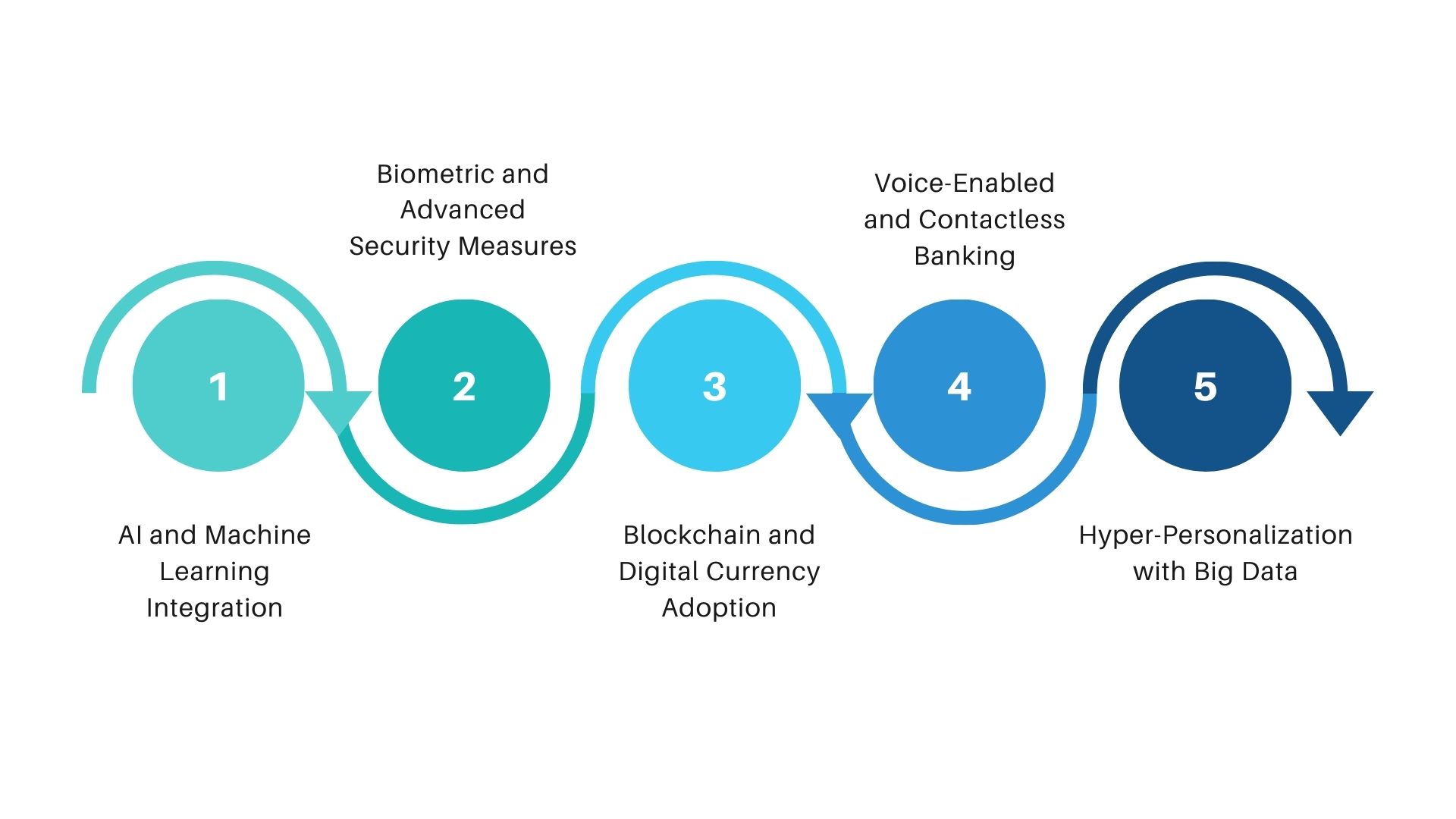

Top Banking App Trends

1. AI and Machine Learning Integration

Artificial Intelligence (AI) and Machine Learning (ML) are transforming banking apps by enabling predictive analytics, fraud detection, and personalized financial insights. With AI in banking applications, users get smarter recommendations for saving, investment, and expense management while banks strengthen security.

- Personalized financial advice based on user spending behavior

- AI-powered chatbots for instant customer support

2. Biometric and Advanced Security Measures

As banking apps deal with sensitive financial data, biometric authentication like fingerprint scanning, facial recognition, and voice verification has become a standard. Advanced security ensures user trust and regulatory compliance. Multi-factor authentication and encrypted transactions further minimize fraud risks.

- Face ID and fingerprint login for secure access

- End-to-end encryption for safe transactions

3. Blockchain and Digital Currency Adoption

Blockchain technology is being adopted in banking apps to ensure transparent and tamper-proof transactions. With the rising popularity of digital currencies and decentralized finance (DeFi), mobile banking apps are integrating features like cryptocurrency wallets and blockchain-powered payment solutions.

- Blockchain ensures faster and more secure cross-border payments

- Crypto wallet integration within mobile banking apps

4. Voice-Enabled and Contactless Banking

Voice banking is gaining popularity, allowing users to perform tasks such as checking balances, transferring money, or paying bills using voice commands. Alongside this, contactless payments via NFC devices are becoming essential, providing speed, convenience, and safety.

- Hands-free banking with voice assistants like Siri or Google Assistant

- NFC-powered contactless payments for a cashless experience

5. Hyper-Personalization with Big Data

Banks are leveraging big data analytics to deliver hyper-personalized experiences to customers. From personalized loan offers to spending insights and customized savings plans, apps are tailored to individual preferences. This trend boosts customer satisfaction and loyalty.

- Tailored product recommendations based on financial behavior

- Real-time alerts and insights for smarter money management

Why Choose OZVID Technologies for Your Banking App Development?

At OZVID Technologies, we understand that building a mobile banking app requires deep expertise, innovation, and compliance with strict financial regulations. As a trusted finance app development company, we specialize in creating scalable and secure solutions tailored to the needs of banks, fintech startups, and financial institutions worldwide.

Here’s why businesses choose us:

Proven Expertise: Years of experience in custom banking software development.

AI Integration: Advanced solutions with AI in banking for smarter apps.

Security First Approach: Multi-layered protection for sensitive financial data.

End-to-End Services: From ideation to deployment and maintenance.

Client-Centric Solutions: Personalized apps aligned with your goals.

Global Reach: Serving clients across the globe with innovative solutions.

Conclusion

The future of banking app development is defined by innovation, customer experience, and digital transformation. Financial institutions must adapt to changing user behaviors by embracing AI, adopting advanced security measures, and staying ahead of market trends.

At OZVID Technologies, we pride ourselves on being a reliable mobile banking app development company that helps businesses unlock the full potential of digital banking. Whether you need the a custom bank application, or end-to-end finance app development, our expertise ensures that your solution is secure, scalable, and future-ready.

If you are ready to embrace the next era of mobile banking app development, contact us to turn your vision into reality.

FAQ's

1. What role does AI play in fraud prevention within banking applications?

AI monitors user behavior in real-time, identifies unusual patterns, and prevents fraudulent activities before they occur, making banking apps more secure and trustworthy for customers.

2. Why is user experience important in online banking apps?

User experience ensures smooth navigation, quick transactions, and trust-building, encouraging more people to adopt mobile banking apps over traditional in-person banking methods.

3. How do mobile banking apps integrate with emerging payment methods?

Modern banking apps integrate with QR codes, NFC payments, and digital wallets, allowing seamless, contactless, and flexible financial transactions for global users.

4. What future innovations are expected in banking app development?

Future banking apps will feature AI-powered advisors, blockchain-powered smart contracts, voice-based banking, and seamless integration with IoT devices for hyper-connected financial experiences.